sales tax rate tucson az 85713

This includes the rates on the state county city and special levels. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in South Tucson Az 85713 at tax lien auctions or online distressed asset.

The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250.

. There is no applicable special tax. The December 2020 total local sales tax rate was also 8700. Ad Solutions to help your business manage the sales tax compliance journey.

Tubac AZ Sales Tax Rate. Shop around and act fast on a new. Tucson AZ Sales Tax Rate.

The City of South Tucson primary property tax rate for Fiscal Year 2017-2018 was adopted by Mayor Council at 02487 per hundred dollar valuation. The minimum combined 2022 sales tax rate for Tucson Arizona is. Ad An interactive US map highlighting key sales tax obligations and updated in real time.

Search for Product Service or Business Name. Tucson Az 85713 tax liens available in AZ. The minimum combined 2022 sales tax rate for Tucson Arizona is.

265000 Last Sold Price. Tucson AZ Sales Tax Rate. Tucson is located within Pima County ArizonaWithin.

The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. Last modified 2 days ago. See reviews photos directions phone numbers and more for Sales Tax Rate locations in Tucson AZ.

Sales Tax Transaction Privilege Tax Sales Tax Rate for. Zip code 85713 is located in Tucson Arizona and has a. Nearby homes similar to 1602 W Ajo Way have recently sold between 195K to 290K at an average of 190 per square foot.

The current total local sales tax rate in Tucson AZ is 8700. The estimated 2022 sales tax rate for 85713 is. The 2018 United States Supreme Court decision in South Dakota v.

Has impacted many state nexus laws and sales tax collection. The Redfin Compete Score rates how competitive an area is on a scale of 0 to 100 where 100 is the most competitive. Tucson Estates AZ Sales Tax Rate.

The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. This is the total of state county and city sales tax rates. Learn how Avalara can help your business with sales tax compliance today.

Less than 3 miles away. The Arizona sales tax rate is currently. This includes the rates on the state county city and special levels.

Sale and Tax History for 1332 S Woodbine Ln. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. The sales tax jurisdiction.

Groceries and prescription drugs are exempt from the Arizona sales tax. Listed by Top Hat Estate Sales. 8am to 3pm Fri 22.

SOLD JUN 1 2022. Sellers use our guide to keep current on all nexus laws and the collection of sales tax. Tumacacori AZ Sales Tax Rate.

The estimated 2022 sales tax rate for zip code 85713 is 870. The Tucson Sales Tax is collected by the merchant on all qualifying sales. The average cumulative sales tax rate in Tucson Arizona is 801.

Arizona Department of Revenue -. The County sales tax. Find the best deals on the market in Tucson Az 85713 and buy a property up to 50 percent below market value.

The current total local sales tax rate in Tucson AZ is 8700.

Merchants Rio Nuevo Downtown Redevelopment And Revitalization District Tucson Az

What S The Arizona Tax Rate Credit Karma

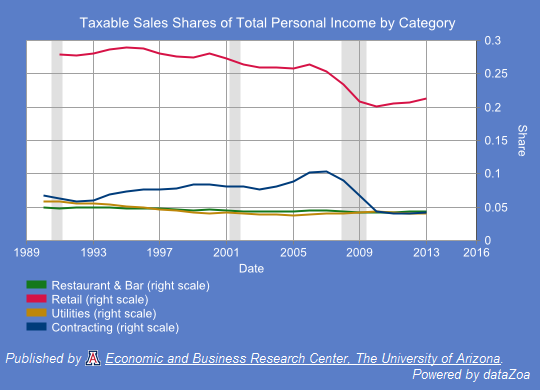

Arizona S Eroding Sales Tax Base Arizona S Economy

Report Unfair Arizona Tax System Unduly Burdens Poor Residents Cronkite News

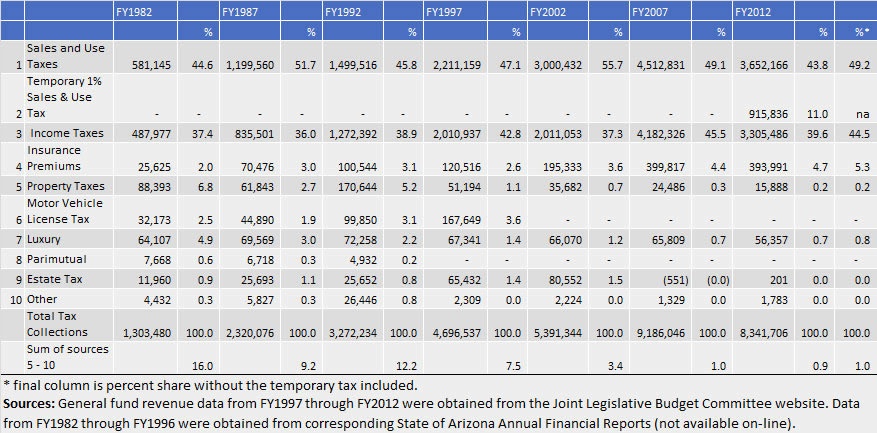

Arizona General Fund Tax Revenues An Historical Perspective Arizona S Economy

How Much Is The Tax On Marijuana In Arizona

University Of Arizona Tucson Az Administration Building Etc Campus Postcard Ebay

Property Taxes In Arizona Lexology

3543 S 9th Ave Tucson Az 85713 Mls 22129629 Zillow

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

Tucsonans Would You Pay More Sales Tax Avalara

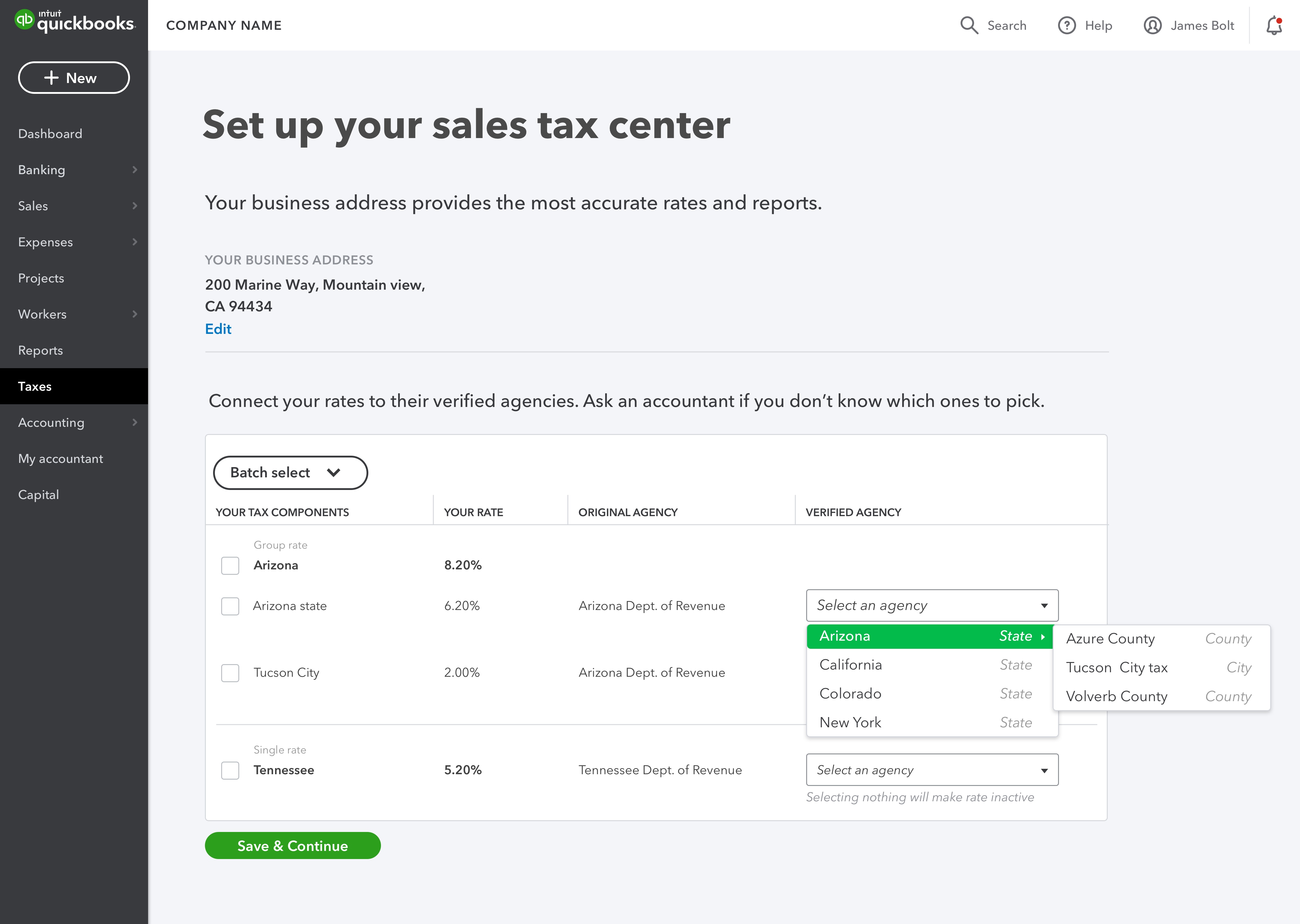

What S New In Quickbooks Online November 2019 Quickbooks

5 Things You Need To Know About Sales Taxes In Quickbooks Online Farkouh Furman Faccio Llp Certified Public Accountants Advisors

Overview Of Arizona State Back Taxes Resolution Options

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

How To Record Use Tax In Quickbooks Online For Sales Tax Reporting Go Get Geek

5 Things You Need To Know About Sales Taxes In Quickbooks Online Virjee Consulting Pllc