special tax notice empower

This statement is provided for shareholders who are United States persons for. Deposit Requirements for Employment Taxes PDF.

Empower Taxpayers Internal Revenue Service

1820513109 Page 3 of 4 the after-tax contributions in all of your IRAs in order to.

. Special Tax Notice Safe Harbor Explanations Eligible Rollover Distributions. 1200 Concord Avenue Suite 300 Concord CA 94520. SECTION 1 - 402f NOTICE.

Special Tax Notice Regarding Rollovers. This Special Tax Notice Applies to Distributions from Governmental 457b Plans This notice contains important information you will need before you decide how to receive Plan benefits. Empower Retirement Form for Purchase of Service Credit.

The Default Investment Notice outlines your rights if you have not chosen funds but are making contributions to the Plan. Retirement Operations OMB No. However the 10 additional income tax on early distributions and the special rules for public safety officers do not apply and the special rule described under the section If you were born on or.

Box 309 Ugland House Grand Cayman KY1-1104 Cayman Islands US Tax ID. Designated Roth account a type of account in some employer plans that is subject to special tax rules. IMPORTANT TAX NOTICE.

Special Tax Notice Fact Sheet. Are eligible to receive from the Plan is eligible to be rolled over to an IRA or an employer plan or because all or a portion of your payment is eligible to. Tax contributions through either a direct rollover or a 60-day rollover.

Special Tax Notice. DC-4253-1105 Page 1 of 4. SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS.

The Special Tax Notice Regarding Plan Payments explains the tax consequences of taking a distribution from your Plan. Post March 8 2018. Post October 7 2020.

This notice explains how you can continue to defer federal income tax on your retirement savings in your retirement plan the Plan and contains important information you will need before you decide how to receive your Plan benefits. This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth account a type of account in some employer plans that is subject to special tax rules. Purposes of the US.

Death During Active Membership Form 104 Read more. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS ROLLOVER OPTIONS Page 1 of 5 Start. A Stable Value Fund for LSERS at Empower Retirement effective 112020.

Empower and Enable All Taxpayers to Meet Their Tax Obligations. Shareholders of Empower Ltd. Important CCCERA Refund Tax Information and Special Tax Notice.

Our approach to the Employee Benefits market is to provide your business options and solutions to benefit the employees that you are looking to reward. Also there generally will be adverse tax consequences if you roll over a distribution of S corporation stock to an IRA After-tax Contributions and Roth 401k plan deferrals as permitted by the plan. Or 18007018255 regarding tax implications when you request withdrawals from your account.

Receiving this does not mean you are eligible for a distribution or that you have requested a distribution. You are receiving this notice in the event that all or a portion of a payment you are receiving from the ExxonMobil Savings Plan Plan is eligible to be rolled over to a Roth IRA or designated Roth account in an employer plan. March 30 2021.

We are deeply sorry for your loss. This notice is provided to you because all or part of the payment. Contra Costa County Employees Retirement Association.

Empower Retirement Form for Purchase of Service Credit. Special Tax Notice Regarding Retirement. When monies are paid out or deemed paid out to a participant a taxable event is created.

Footer link May 26 2015. You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan. You must keep track of the aggregate amount of 1820513109 Page 2 of 4.

Convey information needed before deciding how to receive plan benefits. It explains when and how you can continue to defer federal income tax on your retirement savings when you receive a distribution. Please consult with Empower Retirement at.

You are receivingthis notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan. This notice is intended to help you decide whether to do such a rollover. We help you navigate through administrative issues products and the complicated tax code to provide a variety of solutions.

Death During Active Membership Form 104 Read more. 2020 PFIC Status. This notice is provided to you by.

IRA or an employer plan. Get to know the IRS its people and the. Important CCCERA Refund Tax Information and Special Tax Notice.

402f SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS. Employment Tax Notices. The statements contained in this notice prepared by the Office of Personnel Management OPM are based upon a review of Internal Revenue Service IRS publications specifically Publications 575 Pension and Annuity.

Part I of this notice describes the rollover rules that apply to payments from the Plan that are not from a. Or if your payment is from a designated Roth account to a Roth IRA or designated Roth account in an employer plan. Your Rollover Options for Payments from a Designated Roth Account.

Usually it is included along with the distribution form. After-tax contributions included in a payment are not taxed. If you also receive a payment from a.

Special Tax Notice Regarding Rollovers. Page Last Reviewed or Updated. SPECIAL TAX NOTICE INCLUDING EXPLANATION OF ROLLOVER OPTIONS Your employer or ex-employer sponsored a retirement arrangement 401k plan profit sharing plan pension plan under which you are considered a participant.

Or if your payment is from a designated Roth account to a Roth IRA or designated Roth account in an employer plan. Our staff provides consistent and timely answers to all your questions. If a payment is only part of your benefit an allocable portion of your after-.

Office of Personnel Management Form Approved. Have You Told Your Employees About the Earned Income Credit EIC. SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS.

5 You are receiving this notice because all or a portion of a payment that you. Updated 102020 Your Rollover Options. SECTION 1 - 402f NOTICE.

Part II of this notice describes the rollover rules that apply to payments from the Plan that are from a.

Advanced Wordlist Empower C1 Pdfcoffee Com

The Empath S Empowerment Deck 52 Cards To Guide And Inspire Sensitive People Orloff Judith Ray Elena 9781683648192 Books Amazon Ca

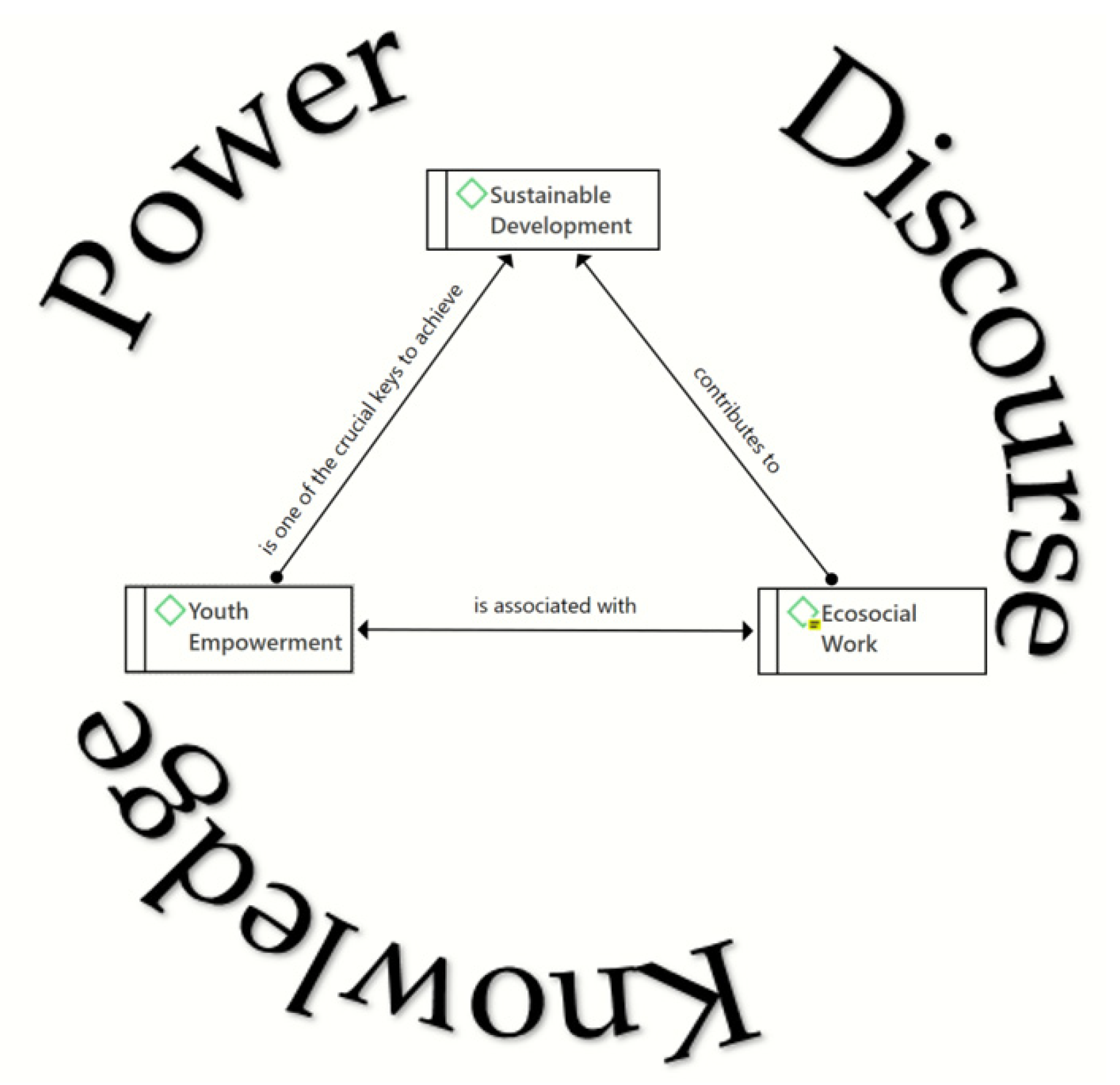

Sustainability Free Full Text Youth Empowerment For Sustainable Development Exploring Ecosocial Work Discourses Html

Empower Renames To Bolster Engagement With Customers Business Wire

Pdf Technology As The Key To Women S Empowerment A Scoping Review

Business Communication Skills Program Iese Business School

Pdf Behavior Change Or Empowerment On The Ethics Of Health Promotion Goals

How To Empower Your Friends Empowering Women Now

Great Lgbtq Speeches Empowering Voices That Engage And Inspire Uglow Tea Holland Jack Tatchell Peter 9780711275003 Amazon Com Books

Great Lgbtq Speeches Empowering Voices That Engage And Inspire Uglow Tea Holland Jack Tatchell Peter 9780711275003 Amazon Com Books

Business Negotiation Strategies Focused Programs Iese Business School

Yes You Re In The Right Place Welcome To Empower Retirement As You Navigate Your Site You Ll Notice Many Of The Pages Still Have A Massmutual Logo That S Okay It Will Take Some Time To Fully Transition You To The Empower Experience We Look Forward To

Yes You Re In The Right Place Welcome To Empower Retirement As You Navigate Your Site You Ll Notice Many Of The Pages Still Have A Massmutual Logo That S Okay It Will Take Some Time To Fully Transition You To The Empower Experience We Look Forward To

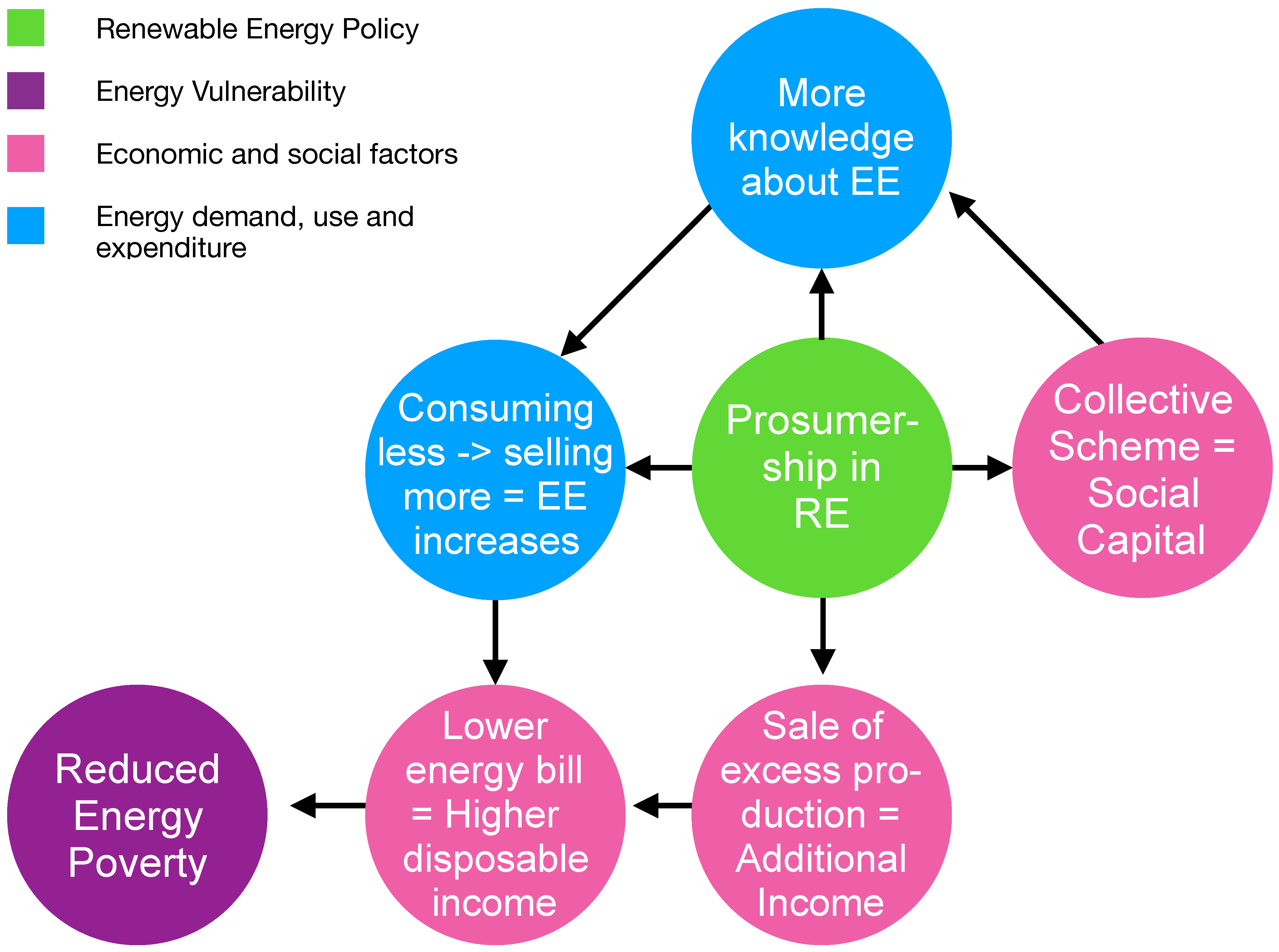

Energies Free Full Text Empowering Vulnerable Consumers To Join Renewable Energy Communities Towards An Inclusive Design Of The Clean Energy Package Html